CoinEx Research July 2025 Report: GENIUS Signed Bitcoin ReACTs

HONG KONG, Aug. 07, 2025 (GLOBE NEWSWIRE) -- CoinEx Research’s July 2025 Report: In July, the crypto market entered a renewed bullish phase as U.S. policymakers formally signed the GENIUS Act. The move propelled global crypto market capitalization above $4 trillion, while Bitcoin surged to a new all-time high of over $123,000. Ethereum followed with a 54.3% monthly gain, powered by a record $5.3 billion in monthly ETF inflows and increased corporate adoption. As the Federal Reserve maintained rates and trade talks with China stalled, market sentiment turned cautiously optimistic. Meanwhile, Solana’s token issuance market underwent a radical reshuffling, and stablecoin inflows hit $8 billion, suggesting that the next leg of the bull run may be underway.

When Policy Pumps Bags: GENIUS Act Ignites Market Rally

The signing of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act on July 18 by President Donald Trump marked a moment for digital assets. Its implementation reinforced confidence in digital assets, particularly stablecoins, fueling market momentum. Bitcoin reacted swiftly, soaring to an all-time high above $123,000, while Ethereum posted a staggering 54.3% monthly gain. On the macroeconomic front, trade dynamics still influenced the market. President Trump secured tariff agreements with the EU, UK, Japan and more, but negotiations with China stalled, sustaining trade tensions. The Federal Reserve maintained the federal funds rate at 4.25–4.50% during its July meeting.

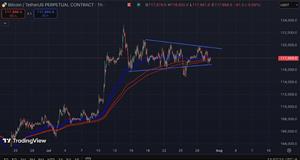

Technical Trends: BTC and ETH

After breaking through to a new high, BTC is consolidating in the blue zone, currently in an uptrend with no signs of weakening.

In the meantime, ETH-BTC rate has turned bullish, breaking above the 338-day EMA trendline for the first time in over a year, potentially poised for further gains.

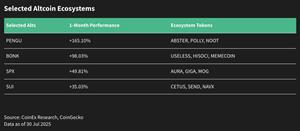

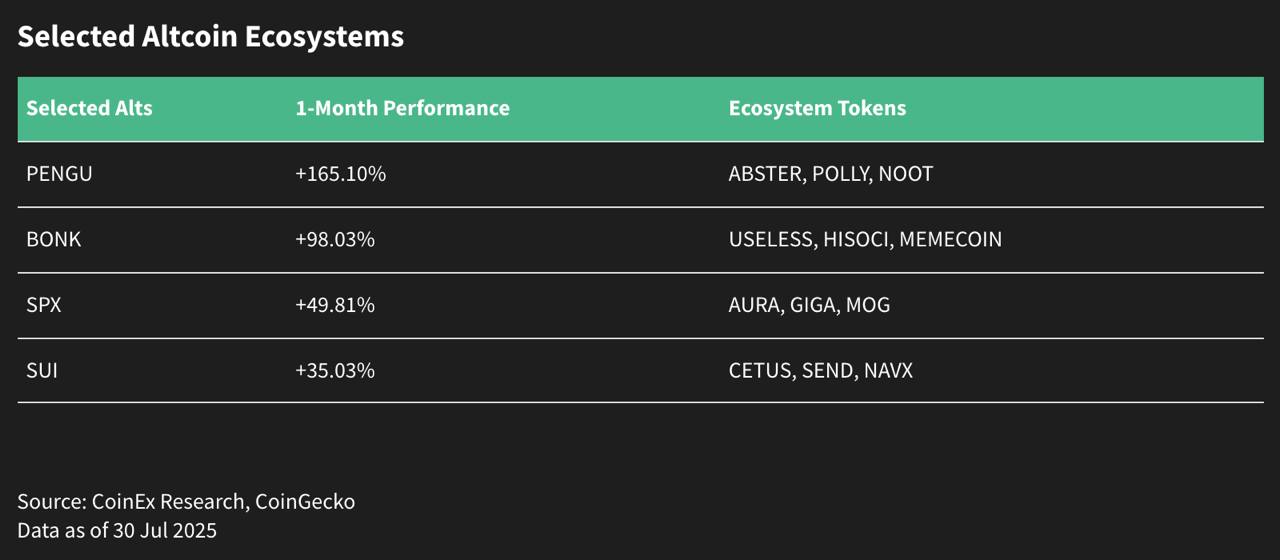

Altcoin Rotation Gains Speed as Risk Appetite Rises

As Bitcoin breaks through its previous high and the ETH/BTC exchange rate surges, CoinEx Research noted an “explosive rebound” in several top altcoin ecosystems as investor risk appetite expanded, increased capital inflows are likely to see.

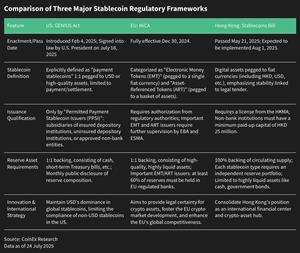

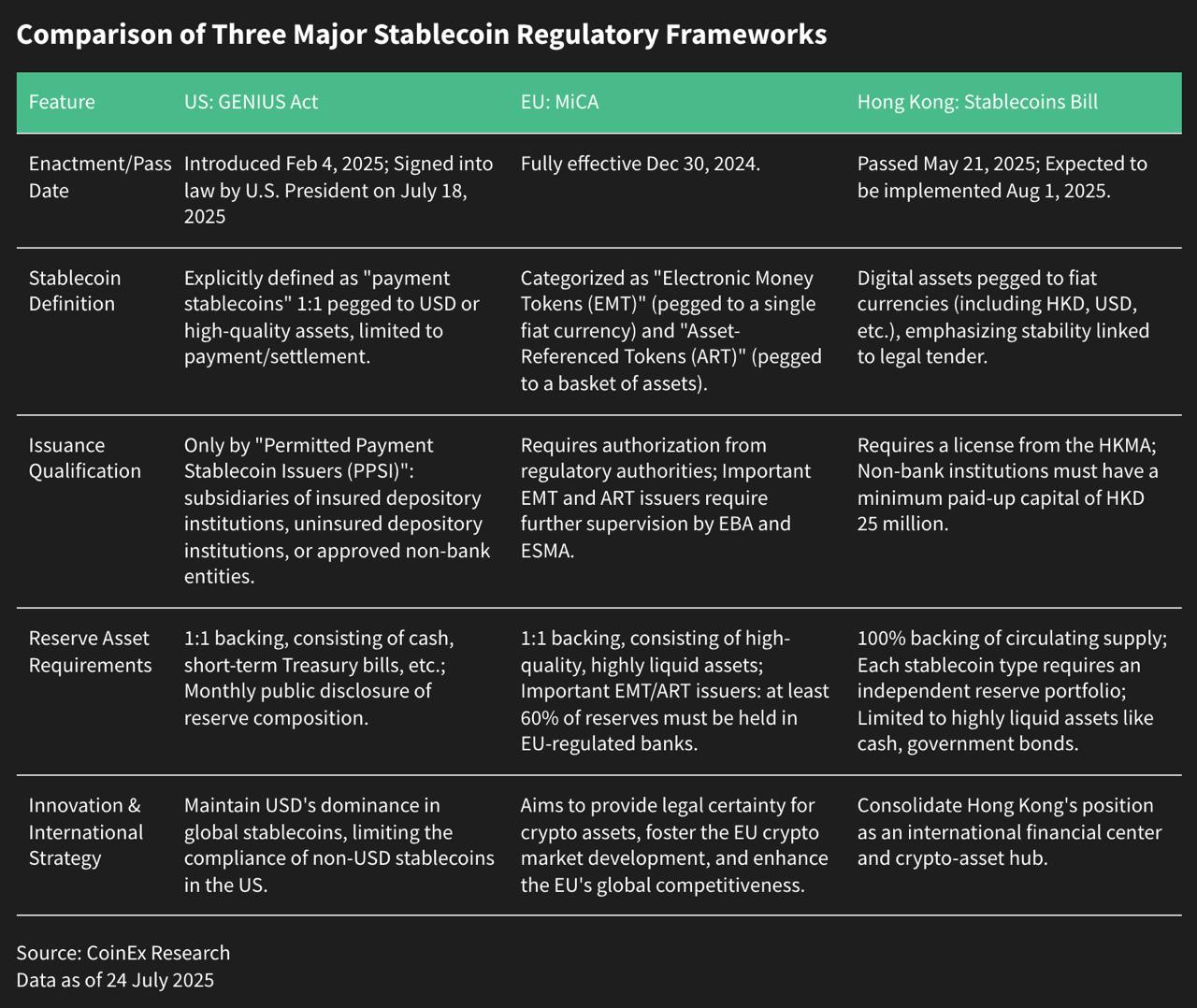

GENIUS Act Signed

The signing of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act on July 18 by President Donald Trump marked a watershed moment for digital assets. The act passed with solid bipartisan support—308–122 in the House and 68–30 in the Senate—and introduced the first formal U.S. regulatory framework for stablecoins. Its implementation reinforced confidence, also aligning closely with the EU’s MiCA framework and Hong Kong’s Stablecoins Ordinance, the U.S. has now positioned itself as a global leader in stablecoin regulation.

For a deeper dive, please read our latest research report: “Global Stablecoin Regulation & Market Outlook: 2025 Trends and Competitive Landscape“.

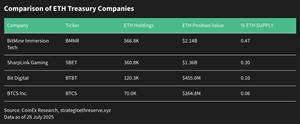

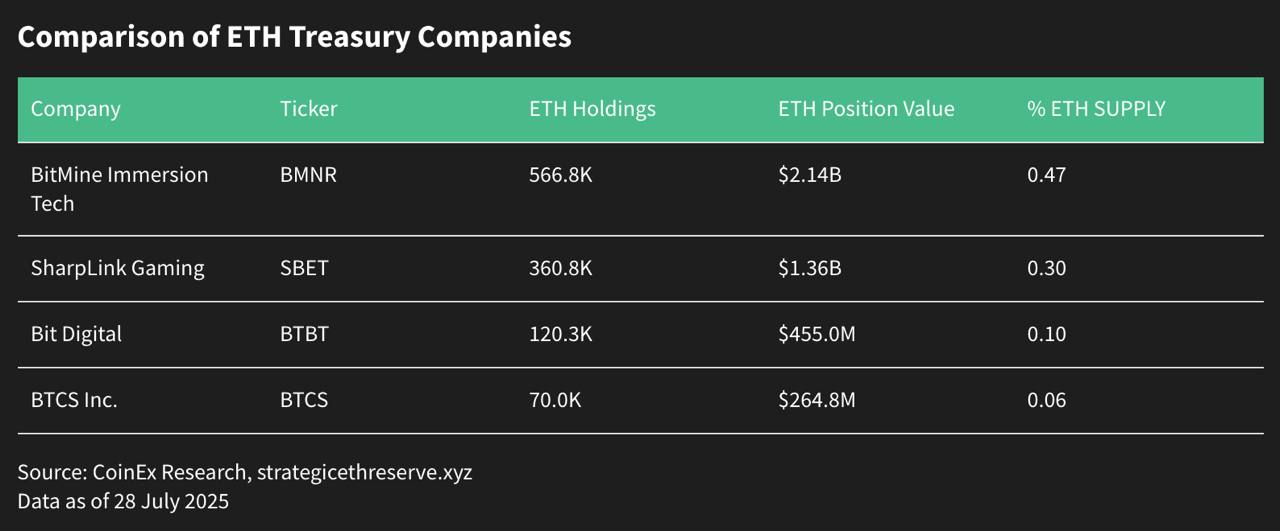

The 'MicroStrategy of ETH' Trend

July also saw a surge in Ethereum adoption among publicly traded U.S. companies. Following in the footsteps of MicroStrategy’s Bitcoin treasury model, firms like SharpLink Gaming (SBET), BitMine Immersion Technologies (BMNR), Bit Digital (BTBT), and BTCS Inc. (BTCS) began accumulating ETH as a strategic asset.

Unlike Bitcoin-focused reserves, which emphasize passive value storage, this strategy leverages ETH’s staking and DeFi capabilities to generate active returns This trend indicates a deeper integration of Ethereum into traditional corporate finance.

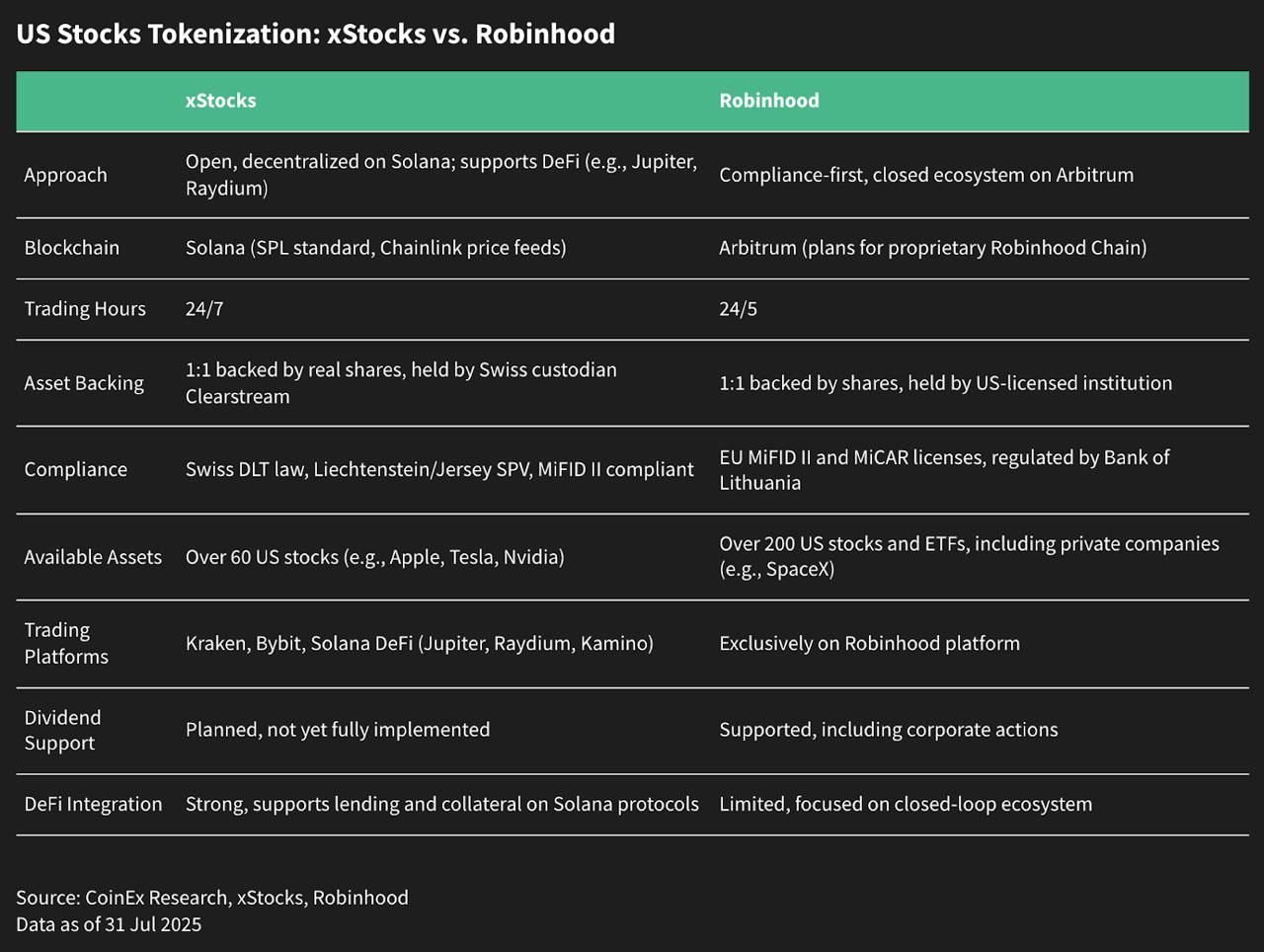

U.S. Stock Tokenization: Open vs. Closed Ecosystems

The tokenization of U.S. equities gained notable traction in July. xStocks, operating on Solana, promotes a fully decentralized framework, offering tokenized versions of top U.S. equities like Apple and Tesla, with 24/7 trading, DeFi integration, and lending options on platforms like Jupiter. While open and accessible, xStocks faces challenges around liquidity depth and regulatory ambiguity.

By contrast, Robinhood has launched a more compliance-first tokenization model on Arbitrum. It provides tokenized access to over 200 stocks and ETFs—including private companies like SpaceX—within a tightly regulated and controlled environment. While this limits DeFi interoperability, it enhances regulatory alignment, especially under EU standards.

Both reshape investing by enabling faster settlements and global access, though regulatory scrutiny and token transferability remain hurdles.

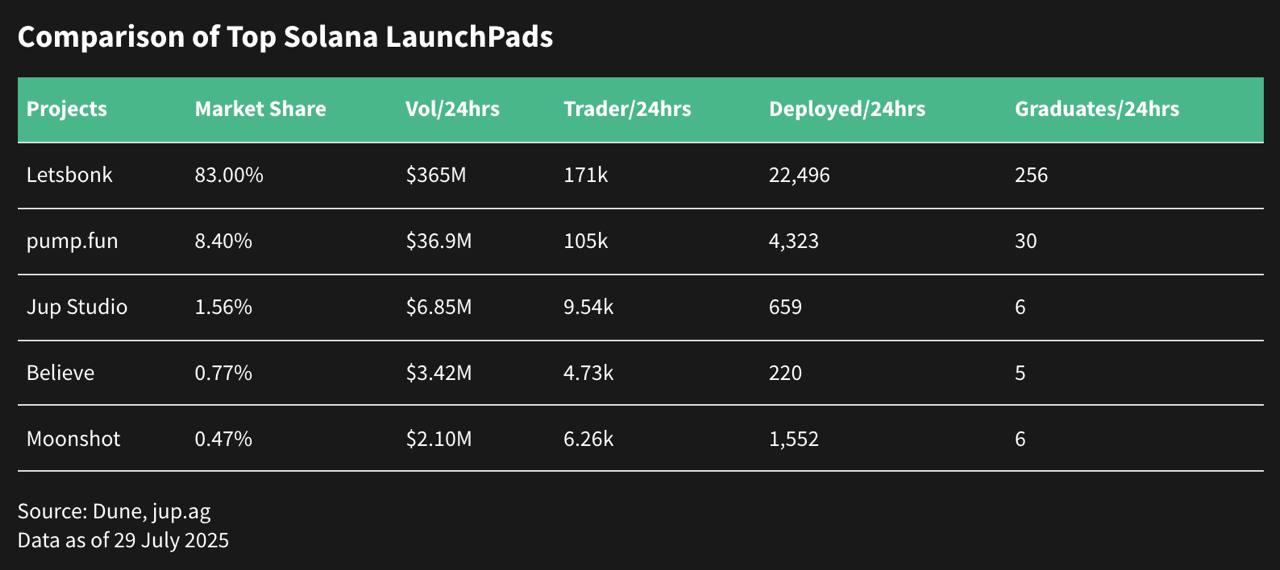

Solana’s Token Issuance: Letsbonk Overtakes Pump.fun

A major shakeup unfolded in the Solana ecosystem, as Letsbonk overtook Pump.fun to become the dominant token issuance platform. As of July 29, Letsbonk commanded an 83.5% market share, launching 256 new tokens in just 24 hours. This success stems from its deep ties with the BONK ecosystem and a community-first revenue-sharing model that prioritizes transparency and fair launches.

Pump.fun, which previously led Solana’s meme coin issuance boom, has seen its market share collapse to just 7.94%. The platform’s decline is tied to backlash over its controversial $PUMP token launch, combined with regulatory scrutiny and internal security concerns.

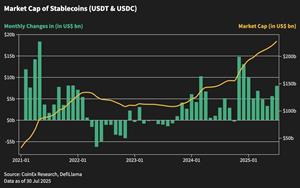

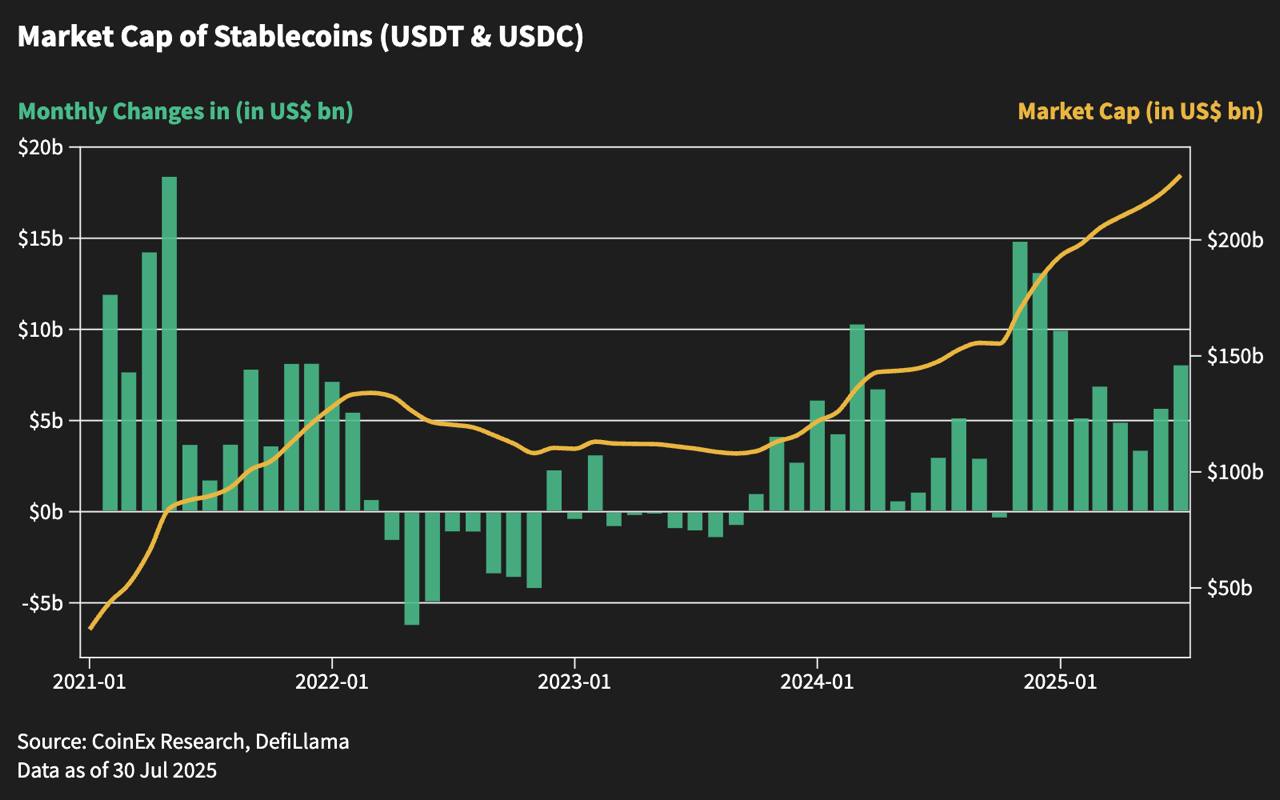

Stablecoin Inflows Hit $8B: Market Signals Next Bull Leg

July saw stablecoin inflows reach $8 billion, marking the second consecutive month of accelerated growth. This uptick strongly supports the bull market structure, confirming that liquidity is re-entering crypto markets at scale. CoinEx Research suggests that if inflows continue at this pace into August, the market could enter the second wave of the bull run.

Looking Ahead: Stable Regulation, ETH Treasuries, and Bullish Momentum

July 2025 will likely be remembered as a defining moment when policy alignment, institutional participation, and market structure converged to fuel a new phase of crypto growth. The signing of the GENIUS Act not only legitimized stablecoins but also triggered a broader risk-on sentiment that reverberated across Bitcoin, Ethereum, and altcoins.

Corporate adoption of ETH as a strategic treasury asset signals deeper institutional integration, while the stablecoin surge, tokenized stock experiments, and Solana’s issuance transformation suggest a vibrant and maturing ecosystem. If stablecoin inflows continue rising and rate cuts materialize, the market may well enter a sustained bull phase.

About CoinEx

Established in 2017, CoinEx is an award-winning cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1400 coins, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, incentivizing user activities while empowering its ecosystem.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

CoinEx

pr@coinex.com

Disclaimer: This content is provided by CoinEx. he statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d714bf1e-b636-4fb2-9a3d-444aa62b1f39

https://www.globenewswire.com/NewsRoom/AttachmentNg/c7990bed-c53f-4cef-8f87-b6f8fc76eee2

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6e84d3d-4c6d-4108-b0a3-892f55a0da21

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f6f9351-5500-4287-8920-11b3eaaca3cd

https://www.globenewswire.com/NewsRoom/AttachmentNg/89d035ab-792b-4898-8452-e42600d84583

https://www.globenewswire.com/NewsRoom/AttachmentNg/dd17973b-4f05-4e85-981a-1cc50f871844

https://www.globenewswire.com/NewsRoom/AttachmentNg/9869d530-4b05-43a1-a87b-b5bdec6d34b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/2b185740-c236-4bb0-a227-d8ec76e61ac0

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.